The Basics of Currency Trading

Foreign exchange trading has quickly become the biggest financial market in the world.

Spot FX is simply foreign exchange traded for immediate settlement (i.e, within 1 or 2 days) as compared to forwards and futures.

Forward rates depend significantly on interest rates in the two countries, where as Spot does not.

Currency Pairs

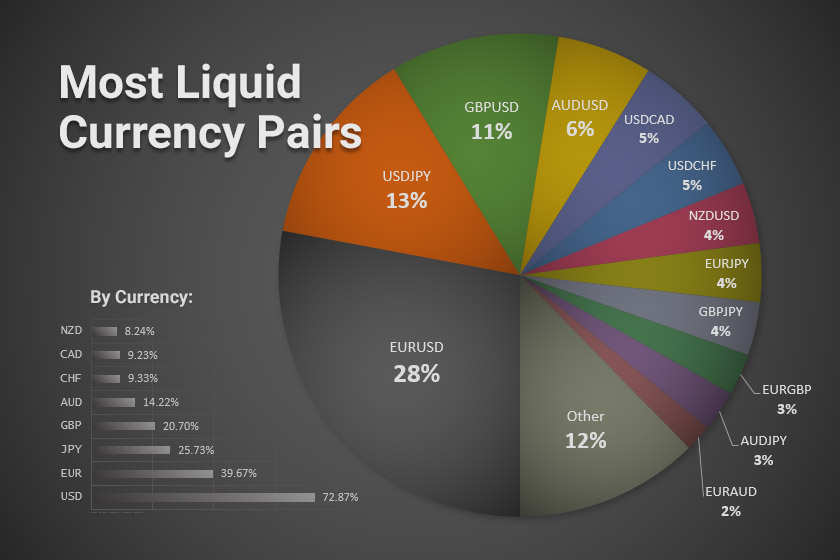

When quoting currency pairs, the priority of currencies are the following: EUR, GBP, AUD, NZD, USD, CAD, CHF, JPY.

Standard currency pairs always have the higher ranked currency on top, e.g. EURAUD, GBPCHF, NZDCAD or CADJPY.

EURUSD trading at 1.1300 means, it takes 1.13USD to buy one Euro.

The major currencies used in forex can be categorised into groups as follows.

Europian Currencies

EUR: The Euro is used by Austria, Belgium, Cyprus, Estonia, Finland, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Monaco, Montenegro, The Netherlands, Portugal, San Marino, Slovakia, Slovenia and Spain.

GBP: British Pound.

CHF: Swiss Franc used in Switzerland.

SEK: The Swedish Krona is used by Sweden.

NOK: The Norwegian Krone is used by Norway.

DKK: The Danish Krone is used by Denmark. Being tightly controlled by its central bank to the Euro, it is not a useful currency for speculation.

Commodity Currencies

AUD: The Australian Dollar, with Australia exporting Iron Ore (20%), Coal (15%) and Gold (5%) of its exports.

CAD: The Canadian Dollar, with Canada exporting Energy (24%), Metals & Minerals (16%) and Motor Vehicles (12%).

NZD: The New Zealand Dollar, with New Zealand exporting Dairy products (25%), Meat (12%) and timber (7%).

BRL: The Brazilian Real.

ZAR: The South African Rand is used by South Africa, Namibia, Lesotho and Eswatini.

Asian Currencies

CNH and CNY: The intenal and external Chinese Renminbi.

KRW: The Korean Won.

SGD: The Singapore Dollar.

Order Types

An order is an instruction to buy or sell on a trading venue. These instructions can be simple or complicated. It can be sent to either a broker or directly to a trading venue via direct market access.

Before trading went electronic, the old order types used to be simple, straight forward and sensible until orders become electronic and HFT entered the picture. Given below are the common order types:

Market order / Risk price: This is the most common and straight forward way of trading. To buy, you pay the offer price. You get the position you want straight away without any aggravation or delay. However, this price also comes with a risk that the market may move between the time the order is submitted and the time it reaches the market. Hence, it is also called the risk price.

Limit Order: A limit order is placed at a specific level and will only be triggered when the market moves to or passes the desired level. The advantage here is that you do not cross the spread. The disadvantage is that the order may not get fulfilled.

if done orders: This is a limit order that once executed, creates another order.

loop orders: This creates only new limit orders over and over again and not just once. E.g. Buy USDCAD at 1.3125. If that gets done, sell at 1.3165 and repeat this process again if the bid comes down to 1.3125. Loop orders are usually used by traders who own options.

fill or kill (FOK) orders: These are either filled completely on the first attempt or cancelled outright and not left on the order book.

all or none (AON) orders: These orders stiuplate that the order must be filled with the entire number of shares specified, or not filled at all. If it is not filled, it is still held on the order book for execution.

Time in force: A day order or good for day (GFD) order is a limit order that is in force from the time the order is submitted to the end of the trading day.

Stop Orders:

Stop Loss Order: This is an order to buy higher or sell lower if the price moves to a certain level. E.g., if I am long on 10 million EUR, each pip is 10m x 0.0001 = 10e(7-4) = $1,000. The current EURUSD is 1.3780/1.3825. If the EURUSD offer (sell) price goes to 1.3780, I want to sell and exit my psoition to limit the loss. This avoids the risk of me watching the EURUSD carry on going lower and suffer even bigger losses.

Sell Stop Order: This is an instruction to sell at the best available price after the price goes below the stop price. It is always below the market price.

Buy Stop Order: This is issued to limit a loss on a buy and is always above the current market price. It can be used to take advantage in a declining market when you want to enter a long position close to the bottom after a turn-around.

Stop Limit Order: This is an order to buy or sell securities, that combines the features of a stop order and a limit order.

You specify two price points:

Stop: The start of the specified target price for the trade.

Limit: The end or outside limit of the target price.

Once the stop price is reached, a stop limit order becomes a limit order that will be executed at a specified price.

It is often used when markets slide so traders can lock in profits and limit losses.

OCO Order (One Cancels the Other): Two opposite Stop Orders are placed for a take profit and a stop loss for the same position. If one side gets executed, the other side is cancelled. This is useful when you could be away from your desk on an open position, so that it is watched. If one side trades, the other side gets cancelled.

Market Orders: Customers give the bank or trading institution an order to execute in the best way they see fit. This is an efficient way to deal when you trust the counterparty you are trading with.

No Worse than Price: Used in the wholesale market, a customer will ask a bank for their “no worse than” price to allow the bank to use its expertise to execute the transaction smoothly. The bank will provide an “at worst” price than the actual execution price which may be substantially better than the at worst price. The bank can share the improvement with the customer, which provides a halfway between “risk price” and “at best” price.

Two Way Price: Where the bank provides a bid / offer on a set amount and let’s the customer decide if he wants to buy or sell based on this amount and price.

TWAP (Time Weighted average Price): This is a volume-weighted average price use for large wholesale FX transactions. It is done by electronically by slicing a large order up into smaller pieces and executing the trade over a given time frame.

Iceberg Orders: These orders are a type of limit order used only in wholesale FX transactions. An iceberg order shows or trades only a small amount of the bigger order to the market. It keeps refreshing or creating a similar order until the larger order has been fulfilled. E.g., given 130 million NZDUSD at 0.6640, the market trading price is currently at 0.6644/46. So as not to scare the market, the trader posts a visible order to sell just 5 million NZD at 0.6645 in batches. The market sees a limit order for just 5 million. But as soon as someone trades that order, it will refresh to show 5 million again. This continues till the trader has sold all his NZD. Iceberg orders are popular in less-liquid currencies.

Dark pools orders are only available for wholesale FX transactions. Dark pools are private stock exchanges run by big brokers that do not reveal immediately to the public trades occurring inside their exchange. They matched buyers and sellers internally, without having to pay the public stock exchanges any fees. This is only viable if the number of trades in these dark pools are high, hence, it only works for big brokerages. They report any internal trade they execute with sufficient delay that it is impossible to know exactly what happening in the broader market when the trade occurs. Traders show an interest to buy or sell currency but do not assign a price to the order. The order goes into the dark pool and waits for someone to match in the opposite direction. When a match occurs, both sides of the trade are filled at mid-market.

System modules of a typical trading system

The three high level functions in a securities trading system are:

Ticker aggregation: This is the software that translates data from public exchanges into a single stream.

Create smart trades: Take the output from the ticker aggregator and use it to figure out sort of trading should be carried out.

Order entry: Take these trades to the market and execute them.

The Players

Corporations: These include JPMorgan, UBS, XTX Markets, Bank of America, Citibank, HSBC, Goldman Sachs, Deutsche Bank, Standard Chartered and State Street.

Hedge Funds: These are pools of investor capital put together to trade various asset classes in search of speculative profits.

Commodity Trading Advisors (CTAs): These are hedge funds that make trades and allocate capital based on computer programs and algorithms.

Real Money Investors: These include pension funds, mutual funds, bond funds, insurance companies and equity hedgers.

High Frequency Trading: These are outfits that profit from small movements and variations in the FX markets.

Retail Traders: These are day traders and speculators performing personal trades.

Central Banks: Central banks operate via four separate channels:

Monetary Policy: is a major driver of foreign exchange rates. High or raising interest rates tend to attract capital and make a country’s currency appreciate, while low or falling interest rates tend to reduce the value of the currency.

Moral Suasion: By telling markets their preference, central banks can influence currency rates without altering monetary policy or intervening in the forex market.

FX Intervention: Central banks can intervene by buying and selling aggressively.

Diversification: Some governments hold massive foreign currency reserves as a tool to either manage their own currency level or protect against a future crisis. Some governments also operate Sovereign Wealth Funds (SWFs)

Currency Carry Trade

A “carry trade” is a strategy where a high-yielding (high interest rate) currency funds the trade with a low-yielding currency. The trader captures the difference between the interest rates, assuming the exchange rates remain the same. The “carry trade” is one of the most popular in forex markets.

How it works

A trader stands to make a profit of the difference in interest rates of the two countries, as long as the exchange rates do not change.

The funding currency is the currency that is exchanged, and typically has a low interest rate. Investors borrow the funding currency and take short positions in the asset currency, which has a higher interest rate. As the rates on the funding currency drops, speculators borrow the money and hope to unwind their short positions before the rates increase.

Example

A trader notices that rates in Japan are 0.5%, while those in the US are 4%.

He borrows the 50 million yen and converts them into US Dollars. At a currency exchange rate of 115 yen per dollar, \(\frac{50m}{115} = US$434,782.61\)

The next step, is to invest those dollars into a security paying the US rate. After a year invested, the trader has $434,782.61 x 1.04 = $452,173.91

The trader also owes 50m yen at 0.5%. The amount owed = 50m yen x 1.005 = 50.25m yen

Assuming the exchange rate stays the same, this is effectively 50.25m yen / 115 = $436,956.52

He thus makes a profit of $452,173.91 - $436,956.52 = $14,217.39

The big assumption here is that the currency exchange rate of 115 yen to the USD remains the same.

Tick and Wave Volume

Reference URL: https://medium.com/@globalprimeforex/why-is-tick-volume-important-to-monitor-56a936eea70d

One of the challenges of trading spot forex is its opaque and fragmented nature, with no exchange or central entity facilitating a transparent volume representation. Trading activity via banks, financial institutions, hedge funds, asset managers and individual traders around the clock makes it very difficult to track in real-time the aggregated volume coming through the books.

Tick Volume

Tick volume measures the number of times the price ticks up and down.

Tick volume activity and actual traded volume in spot forex exhibit a relationship that is extremely high.

Volume is a very important piece of information because it influences how prices move and communicates the involvement of big money. Volume is the fuel that causes new cycles and tells us the degree of commitment that exists to endorse a certain buy or sell campaign.

Caspar Marney, a veteran forex trader debunked the myth of limited usefulness of tick volume in spot forex. Casper, after a thorough study, concluded the existence of striking high levels of accuracy between tick activity and actual traded volume, which indicates the importance of tick data.

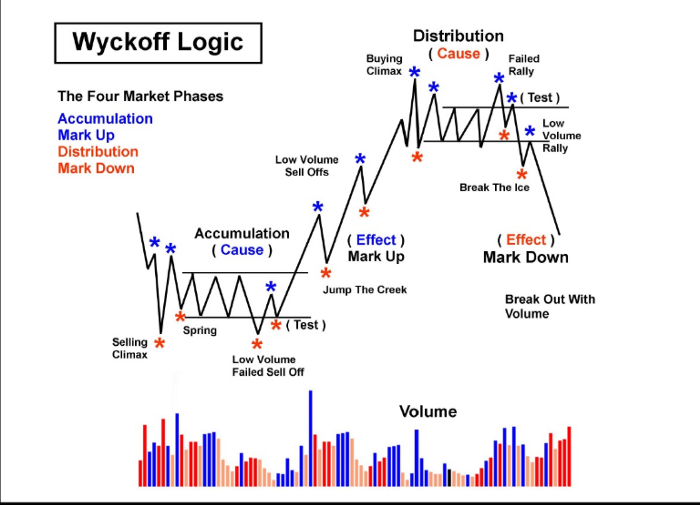

This relates to the influences of volume in trading, by Richard Wyckoff, presented as a research paper known as Wyckoff Analysis, show below:

Wave Volume

With Wyckoff analysis, one can identify wave volumes of trades that makes prices go up or down. Traders usually have a wave volume indicator to show how trades move, which needs to be used in context to other trading statistics and trading history to decide to put a buy or sell order.

David Weiss thus created a wave volume indicator, so that it is also called the Weiss Wave indicator.

Generally, with this wave indicator, traders would put in multiple orders around a target price to increase their chances of successful buy and sell orders, taking advantage of these waves.

Non Deliverable Forwards

Non Deliverable Forwards exists for countries with economically developing markets where their currency cannot be freely converted and are typically specified against the US Dollar.

For example, a US technology company just delivered an order to a Thai customer, and is expecting a payment of 30 million baht in 90 days.

The current spot rate is THB 30/USD.

Hence, in 90 days, the US company would expect to get THB 30,000,000/ 30 = USD 1,000,000.

To mitigate against the adverse currency fluctuations, the US company enters into a NDF with a bank.

The bank quotes the 90-day forward rate of THB30/USD for purchasing the baht.

This helps the company lock in getting USD 1,000,000.

NDFs are cash-settled, usually short-term forward contracts. The notional amount is never exchanged, hence its name “non deliverable”. Two parties agree to take opposite sides of a transaction for a set amount of money at a contracted rate. The counterparties settle the differences between the contract NDF price and the prevailing spot price. \(Cash Flow = (NDF\ rate - Spot\ rate) * Notional\ amount\). Besides the Notional Value, an NDF contract includes:

Fixing date: An agreed upon date when the spot rate and the NDF rates are compared, and a notional amount is then determined.

Date of settlement: The day that both parties agree to make the difference between the exchange rates due; one party pays the other part on this day, while the recieving party retrieves the difference of the rates in cash.

NDF rate: The rate that is agreed upon on the date of the transaction. It is the straight forward rate of the currencies involved in the exchange.

Spot rate: The most upt to date rate for the NDF, as provided by the central bank.